Looking for financial advice? We offer all clients a no-cost and no obligation review at our office, your home or using video conferencing technology!

At Financial Fortress, we maintain the highest levels of service and guarantee no jargon! No long wait times on the phone and easy to reach named & dedicated advisers!

A review with us will ensure you fully understand your plans, maximise your savings & the investments. We are obsessed with ensuring you a successful & secure future.

How To Spot A Pension Scam!

With 2024 advanced technology and AI its become even easier for criminals to fool people out of their life savings! This really makes us angry, you save your whole life and some low life scum-bag convinces you to give your money away. Sounds like fantasy but the FCA estimates up to 40% of pension transfers…

We have some exciting news! Introducing, The Financial Fortress Forum…

We have some exciting news! Introducing, The Financial Fortress Forum. The Financial Fortress Forum is a fresh new platform to chat about all things finance. Unlike other platforms we are involved in, our new forum allows our users to create their own topics to open a discussion and receive the answers to questions. An easy…

Tax planning could be harder – if you are Scottish!

BREAKING NEWS (19/12/2023)! Scotland will now have 7 distinct rates or bands of tax whereas the rest of the UK will still have 4. Could this get any more confusing? Basically, in the Rest of the UK (R.UK) there are 4 income tax rates as follows: Income RateNameUp to £12,570 0% Personal Allowance£12,571 to £50,270…

Looking Back At 2023

Looking back at 2023, one thing is certain – things do not stay still for very long and we at Team FF have had the busiest year on record! Not only have markets generally continued to be very chaotic with geo-political events not helping (think Ukraine, China and Palestine) and all the stress this brings…

FREE Financial Advice!

Financial Fortress Ltd in Chester is committed to developing its colleagues and after 5 gruelling years, our apprentice, Kieran Broster has qualified as an Independent Financial Adviser. To assist with his development, we are seeking 5 clients who would like a pension or investment review FREE of any initial charge. All meetings and advice will…

Why is rising inflation a problem?

Anyone who reads our blogs, will often come across our warnings of inflation and the danger it presents to any economy. To “an average consumer”, it really is very hard to understand just how dangerous and damaging inflation is but given it has been stubbornly high (still over 8%) for quite a while this is…

What if your financial company goes bust?

Anyone with an interest in financial markets will have looked back at 2008 (AKA the “Credit crunch”) and realised the economic shocks that can be caused by a bank “getting into financial trouble”. Think Northern Rock/RBS/NatWest and Lloyds for example getting into financial difficulty. Before 2008, I can remember no client ever worried a bank…

Why is rising inflation a problem?

Anyone who reads our blogs, will often come across our warnings of inflation and the danger it presents to any economy. To “an average consumer”, it really is very hard to understand just how dangerous and damaging inflation is but given it has been stubbornly high (over 10%) for quite a while this is leading…

Budget March 2023

Very interesting decisions being made and few shocks and surprises for us financial folk! Here we summarise the decisions that we think will affect our advice to clients: Lifetime allowance (LTA) scrapped. After 6/4/23, there will no longer be a lifetime limit applied to pension savings. Currently this is £1,073,100. Therefore any member will be…

You may be one of the people who paid £17.9billion in tax but could have avoided it!!

The Government has been accused of hiding “figures in the small print” after HMRC admits that pensioners in the 2016-17 tax year actually paid £4.4billion more in tax than previously thought after making withdrawals from their pensions. The true figure was £17.9bn in tax, whereas until now, HMRC had admitted to only £13.5bn! How does…

The end of the tax year is approaching!

Just a little reminder to our clients the tax year ends on 06th April so if you have any unused ISA or pension allowances the money needs to be invested by then! Wake up on the 6th April not having used your allowances and they could be lost forever! As a reminder, you can put…

The rise of the “tax-traps”!

England & Wales only – Scotland sets its own tax rates and bands! Following the mini-budget in November 2022 the Government has introduced what we would call “stealth-taxes” and “tax-traps” designed to allow them to announce that there are no major tax rises whilst dragging more and more people into either paying tax or higher…

“Safe havens” performing badly? – A double whammy for investors!

Something very unusual has happened lately in the fact that what would normally consider to be “safer haven” investments have seen lots of negative fluctuations in value. So, what has been happening? Following Truss/Kwarteng “mini-budget” and the generally high inflation rates appearing across the world there was a large sell off in (traditionally less volatile…

Interest rates!

You may have seen the rise in interest rates recently where they have gone up from all time record lows of just 0.25% to the current 2.25%. Financial analysts are now pencilling further rate rises and it is largely expected they could reach dizzying heights like 6 or even 7% in the not-too distant future. …

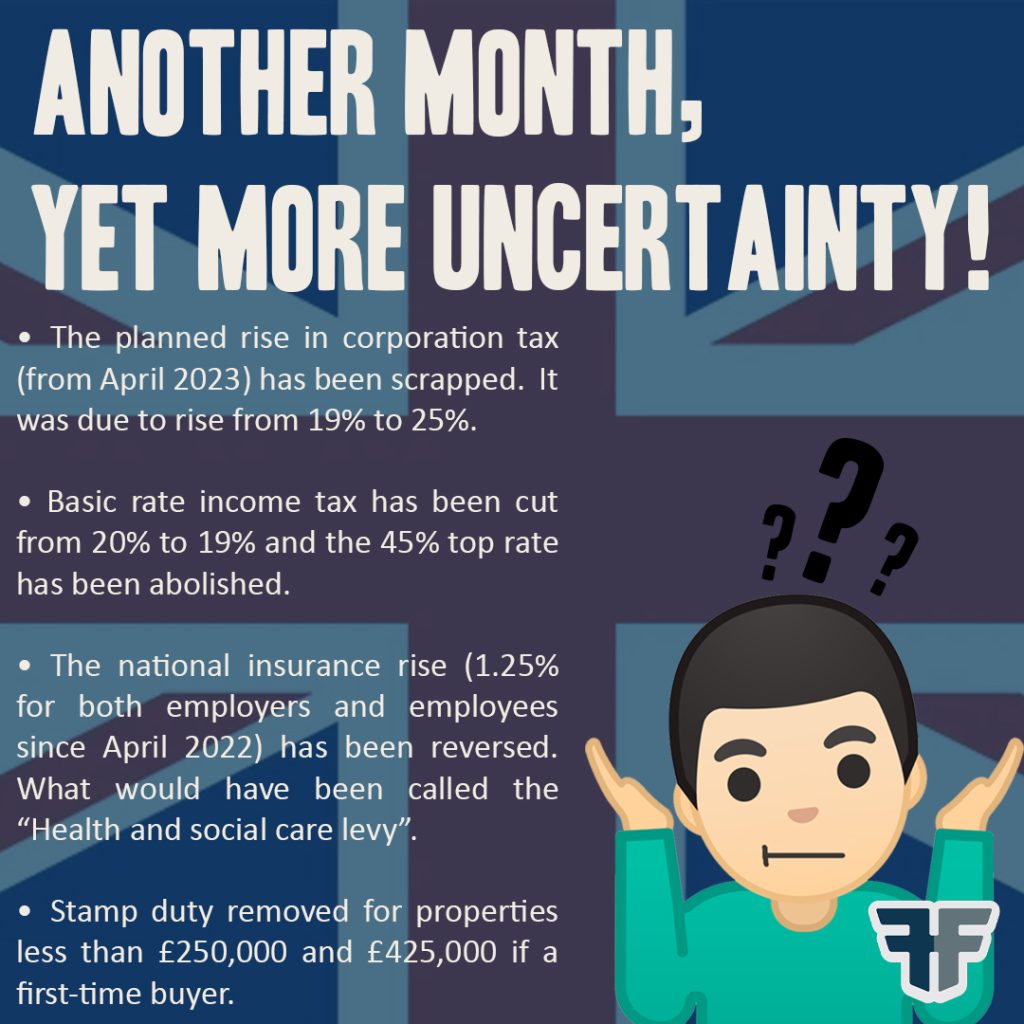

Another month, yet more uncertainty!

Firstly, we would like to start this month’s newsletter by paying tribute to Queen Elizabeth II whom sadly passed away this month. Regardless of any political view, Her Majesty was a bastion of stability and “Team UK’s” number 1 fan. The dedication and service shown to everything and everyone in Her kingdom will be sadly…

Pension Scams – How To Spot!

This really makes us angry, you save your whole life and some low life scum-bag convinces you to give your money away. Sounds like fantasy but the FCA estimates up to 40% of pension transfers are linked to either fraud or un-regulated and unsuitable solutions! We have at least 4 clients who have been ripped…

Doing what we do best!

Mr & Mrs Jones came to Malcolm recently as they were on their mortgage lenders standard interest rate having not reviewed it for some time. After Malcolm’s hard work he obtained an offer which was accepted just 60 seconds after the application was submitted! Malcolm reduced their interest rate from 5.38% to 3.54%. Keeping their…

Stock market panic – is now a good time to invest?

Wow, now there is the million-dollar question! As you may know, markets generally are battling with a number of pressures and have reacted in the main by recent falls – the American S&P 500 is over 20% short of its January peak for example. Whilst this is extremely worrying to our clients, there will always…

Why you should remain invested even in volatile times!

Markets are always un-predictable and the past few years have seen levels of uncertainty like never before. With economic uncertainty, this translates to unpredictability and then into volatility and rattled markets. Whether it is an unprecedented global pandemic or a certain Mr Putin’s invasion of Ukraine, they have been particularly volatile of late. Build in…

Em & Phill’s 1m Steps Challenge For – Hospice Of The Good Shepherd

As we approach the middle of may Em & Phill have reached the half way point of their challenge for Hospice Of The Good Shepherd. The boys have already completed a huge 553,463 steps so far meaning they are way ahead of schedule as they aim for their 1 million steps! Em & Phill had…

Buying into the defence spending boom!

Since Russia’s invasion of Ukraine, all countries have been reassessing their defence spending and things that may have seemed like an impossibility just a few months ago (Germany supplying arms to a conflict zone or Finland & Sweden joining the NATO alliance) are now the “new normal” and being taken very seriously! Sadly, the largely…

Could Russia inspire massive ethical investment?

Anyone who watches the news will have seen the terrible, heart wrenching news that Russia has decided to declare a war… err we mean a special military operation on one of its neighbours Ukraine and the devastating fallout continues to have serious ramifications for the global economy and in particular the Russian economy itself! So…

Russia and Ukraine – Markets update

Just as we thought that the post-Covid world was in reach with all the assumptions of a return to a more predictable and secure set of market conditions, a certain Mr Putin attempts to start what could easily become World War 3. The build up to the confrontation in Ukraine caused elevated levels of volatility…

Q&A With Our Mortgage Adviser Malcolm Gorton

This week we sat down with one of our mortgage advisers Malcolm Gorton, to discuss some of the common questions we receive from our clients and followers regarding mortgages and the current state of the market in 2022 . This is what Malcolm had to say: Q: Is now a good time to buy? A:…

Average ADVISED client better off by £47,000!

Client’s receiving professional & ongoing financial advice between 2001 and 2006 were on average £47,706 better off by 2014-16! Wow what a stat and really shows the potential power of using a great financial adviser (like us)!! Research by Royal London and the International Longevity Centre (ILC) released recently went on to say that “people…

Private Healthcare

We can all agree our NHS service is fantastic, available to UK residents completely free of charge. However, the waiting time for diagnostic testing and treatment is huge not to mention frustrating. According to the NHS website the maximum waiting time for non-urgent, consultant-led treatments is 18 weeks – this is from the day your…

Is rising inflation a problem?

Anyone who reads our blogs, will often come across our warnings of inflation and the danger it presents to any economy. To “an average consumer”, it really is very hard to understand just how dangerous and damaging inflation is. The last time it was out of control in the UK was over 50 years ago…

Make the Most of your Retirement with Equity Release

Over 55? Short of income in retirement to live the life you would like? Looking to gift a relative money? Repay an existing mortgage or unsecured debt? Landscape your garden? As people now are living longer and longer we are finding more and more of our clients are enquiring about lending in retirement. As Professional…

Sign our Petition to Parliament – Abolish VAT on Defibrillators

Please sign our petition to parliament to make defibrillators cheaper by removing the VAT! All grass roots and voluntary clubs would get a 20% saving off the cost of life saving equipment! http://chng.it/QYNQ4WLM Small business that are not VAT registered, those that are VAT exempt including most voluntary/community/charities would all need to pay the extra…

The economic case for an independent Scotland (or not)!

Following Scottish local elections, the SNP (Scottish National Party) fell just short of an overall majority in the Scottish devolved assembly responsible for any devolved matters. However, looking at the others result it is clear that a majority of members were returned on a “pro-independence” ticket! Arguments about whether this is the right time (given…

Is this the year of the UK?

According to the Bank of England and many other commentators, the UK is about to enjoy its fastest rate of economic growth for over 70 years! Not since 1951 and the end of devastating conflict has growth like it been seen! The Bank of England has published it expects growth in GDP of 7.25% in…

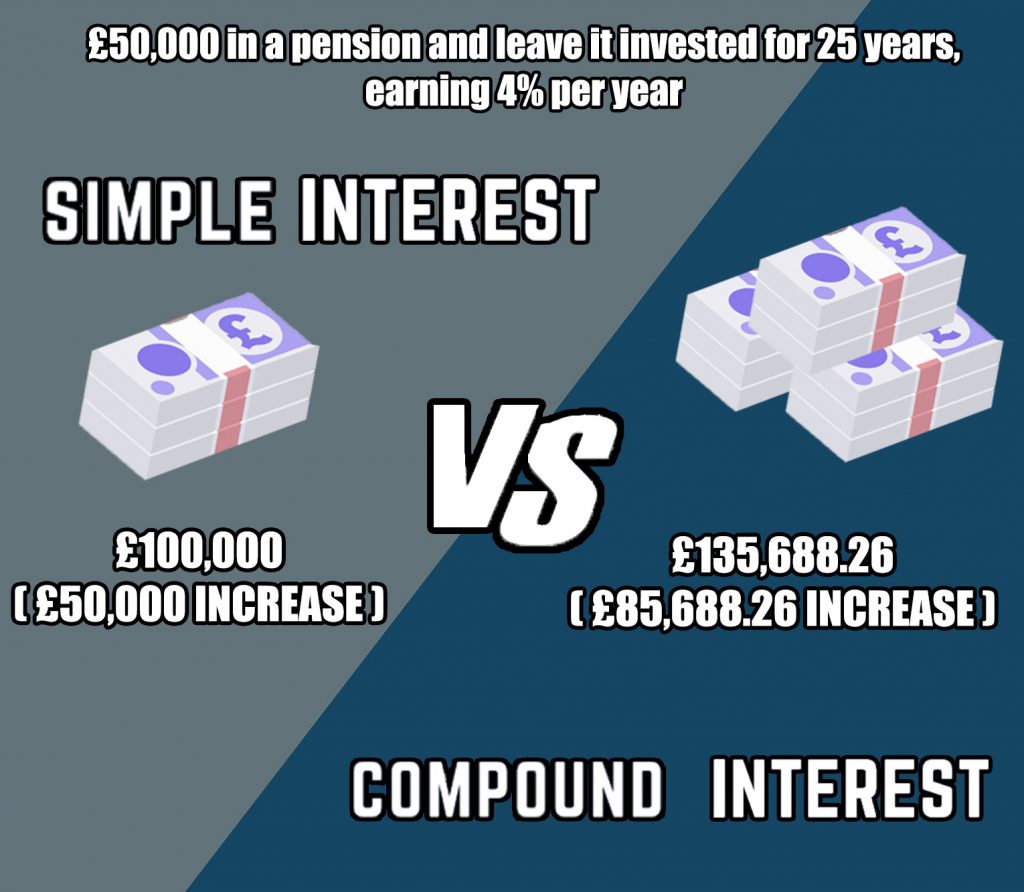

Simple Interest Vs Compound Interest

A basic principle of investing is compound interest! Basically it is where you invest for the long term and essentially earn “interest on your interest”! For example, lets pretend you have £50,000 in a pension and leave it invested for 25 years, earning 4% per year. Here are the results: Simple interest: £100,000 (£50,000 increase)…

Another 5 Star Review For Financial Fortress

5 star review! ” If you are first time buyer and headache of mortgage, please speak to Malcolm!!! he really helped me a lot to help me out of the predicament. At the beginning I undoubtedly trusted the broker recommended by the estate agent but sadly they took 3 weeks more and only gave me…

Doing well by doing good! (ESG investing)

This seems to be the big thing right now and our regulator (the FCA) is moving to make discussion of ESG (Ethical, Sustainable & Governance) part of every investment review. So why is this and does it really matter? Why consider ESG? ESG considerations is being driven largely by 3 factors as follows: Client demand…

Budget 2021“The stealth budget”

Well, it came and went as we knew it would, but the surprising thing is there were definitely no dramatic tax rises (other than corporation tax rises for companies making over £50,000 per year). The vast majority of us could be forgiven for thinking not a lot will change, however – as always the devil…

STOP PRESS! Budget and the lifetime allowance

If you have total pensions approaching the Lifetime Allowance limit £1,073,100 you may be interested to know the allowance has been frozen until at least 2026. It was expected to increase on 06th April every year (to maintain its value) but this “small change” will mean many more pension savers will trigger a tax charge…

Beware the Great Wealth Tax!

In 2020, the Government announced they would look at a one-off “wealth tax” to help balance the books and the department responsible has now reported its findings with some very surprising recommendations! If you have more than £500,000 “wealth” you could be caught up! Basically, what is suggested is a “one-off” wealth tax of 5%…

Beware the Property Tax!

Do you pay council tax? Then read on! As we keep banging on, the UK is in a “bit of a pickle” having spent our grand-children’s taxes (let alone the taxes being raised today) and therefore being rocket-scientists, we are trying to best guess what taxes could raise next (and then helping our clients avoid…

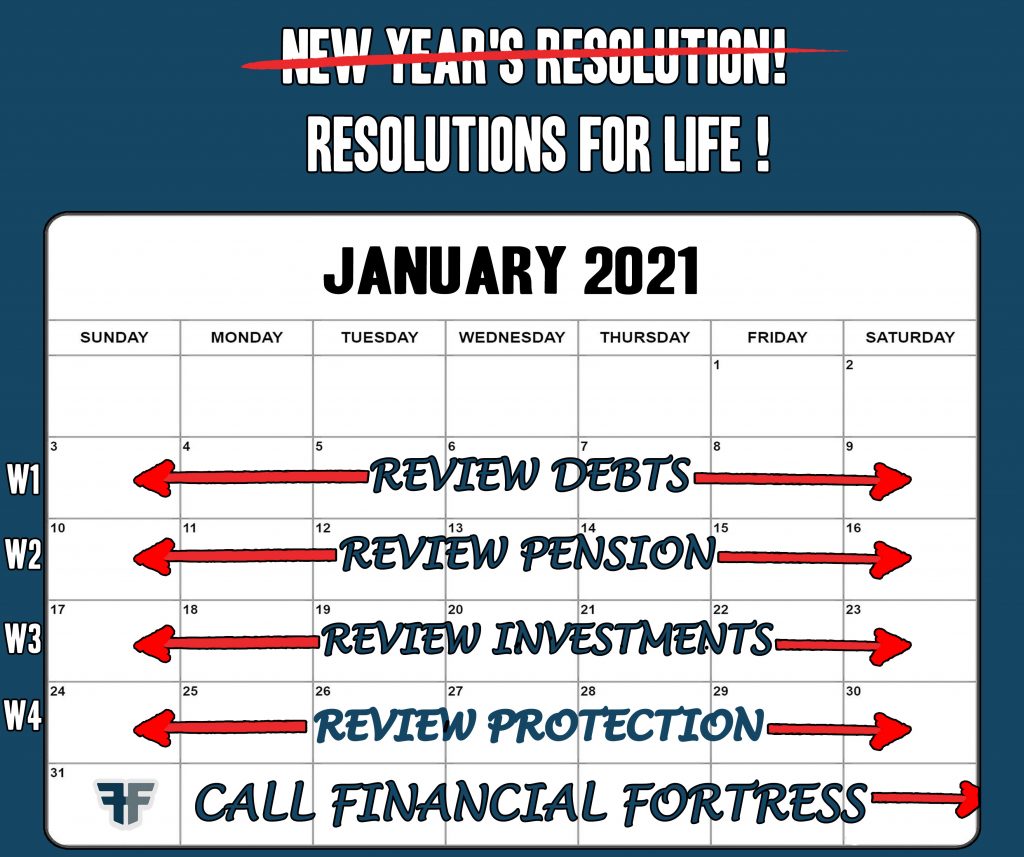

Happy New Year! It’s 2021 and if lockdown has boosted savings make your resolutions for life, not just for the New Year!

There is no better time than now to review your finances. Despite the doom and gloom of lockdown due to Covid-19, on the positive side millions have found themselves saving more money than ever before. Statistics show the percentage of disposable income that households have saved has risen to an all-time high, with four in…

Estate Planning – Business Property Relief

Escaping the dreaded inheritance tax can be a worry but where your estate (everything you own) is worth more than £1million a tax bill of 40% can be even worse! Many clients come to us as they want to escape this easily avoided tax but still require access to their money! According to research by…

Is a “Green Revolution” really coming to the UK?

In 2019, the UK became the first major economy in the world to actually pass legislation binding itself to achieve net-zero carbon by mid-21st century! The UK was a trail-blazer in this regard and has now been followed by the EU, South Korea and Japan. Even China is talking about something similar, aiming to achieve…

The impending tax raid!

As clever as we may be, rocket scientists we are not! However, it doesn’t take a rocket scientist to understand the Chancellor of the Exchequer will soon need to start plugging the massive £300billion hole in the public books. What could this possibly mean? Put brutally, less public spending coupled with higher taxation. Reading between…

Ethical Investing….

More and more clients are becoming interested in ethical investments and with the TV constantly spitting out dramatic footage of our plastic littered sea’s, rivers being poisoned or reporting a steady stream of man-made disasters, we believe the demand will only increase for ethical investments in the coming years. There is even a stock market…

One-third of UK investments and pensions still paying commissions!

Investments and pensions taken out since 2012 are what we in the industry call “clean” shares meaning the annual management charges are as low as possible and the share itself doesn’t murkily and perpetually pay commission to the adviser that set it all up. In the bad old days before the industry tried to clean…

Bank of Mum and Dad goes – err mad!

According to Legal and General, the amount lent to family members entering the property market in 2018 rose to £5.7bn The average contribution from a family member was £24,000 making family the 11th largest mortgage lender! How can this be explained? Well, as average house prices have continued to rise and wages under pressure coupled…

Another 5 star review for Financial Fortress!

Can’t recommend Financial Fortress highly enough Ian Daltrey provided us with outstanding advice for overhauling our pensions, explained everything every step of the way and made everything so seamless that took all the worry away for us. So happy with the advice and service we have received.

Act NOW – Amazing investment opportunity!

Given Lockdown 2 is now upon us, our investment management team has been busily scouring investment opportunities and believe we have spotted an amazing opportunity but be quick! We have received “insider information” which has even been picked-up by the BBC! WOW! ACT NOW! What could these investment opportunities be? We have it on very good regard that there are lots of “numpties” and “irrational thinkers” currently “stock-piling” toilet paper…

Focus on fraud – the interception scam!

Fraud is definitely on the increase and recent stats show around £58 million getting scammed with “Corona-inspired” scams this year! Here we explain what is meant by different types of fraud and how to protect yourself! The “interception scam.” Pretty simple really, fraudsters “intercept” your email (Cyber-space) or letters (Snail-mail), alter the bank/contact details and…

(Fraud?) An unbelievable investment opportunity for our’ readers!

Fancy a “guaranteed 10%+ annual return”? Then read on… An existing client has sent us a brochure for an amazing investment they have come across, so we are putting this out there… Would you invest? There is a very well published, professional looking 32-page brochure available inviting you to invest in …. Wait for it…….

Focus on fraud – the unregulated investment scam!

Fraud is definitely on the increase and recent stats show around £58 million getting scammed with “Corona-inspired” scams this year! Here we explain what is meant by different types of fraud and how to protect yourself! The “unregulated investment scam” Pretty simple really, fraudsters (sometimes even genuine advisers!) convince you invest your hard-gotten savings (or…

Wrexham based advice firm defaults leading to claims on the FSCS!

REX Financial Services defaulted in September after ceasing all regulated business in the July, leaving its clients in the lurch and potentially facing huge losses. The FSCS (Financial Services Compensation Scheme) has already received many claims against REX for “dodgy” advice, specifically regarding “self-invested Personal Pensions – or SIPP’s”! The bad thing is, as a responsible firm,…

Could inflation exceed 2%?

Inflation is vital, as we keep saying. The ability for people to plan-ahead and gently encourage us all to spend our money is vital and this is why steady, managed inflation is important. A figure of around 2% is seen as “economically required” long term. Why? – Well imagine if the price of bread rose 100%…

Prepare for negative interest rates!

The Bank of England has now written to the UK retails banks, making sure they are prepared for negative interest rates!! This is not a new thing (on the international stage anyway), Japan and Switzerland are both trail-blazers in this regard but what is happening and what would this mean to your wealth? Under any…

Congratulations to our Apprentice Ryan!

Being as passionate about our team members as we are our clients, we are delighted to announce that our Apprentice Marketeer, Ryan has passed the first of his 3 exams taking a great step forward towards being awarded the BCS Level 3 in Marketing Principles! We are extremely proud of Ryan, his achievements and his…

Keep your finances on track!

As our existing clients know, we always get together at least once per year to check their investment and pensions, allowing for any changes in the year whilst making sure their long-term plans (such as a happy retirement) remain on track! We also have no doubt that in January we will be inundated with new…

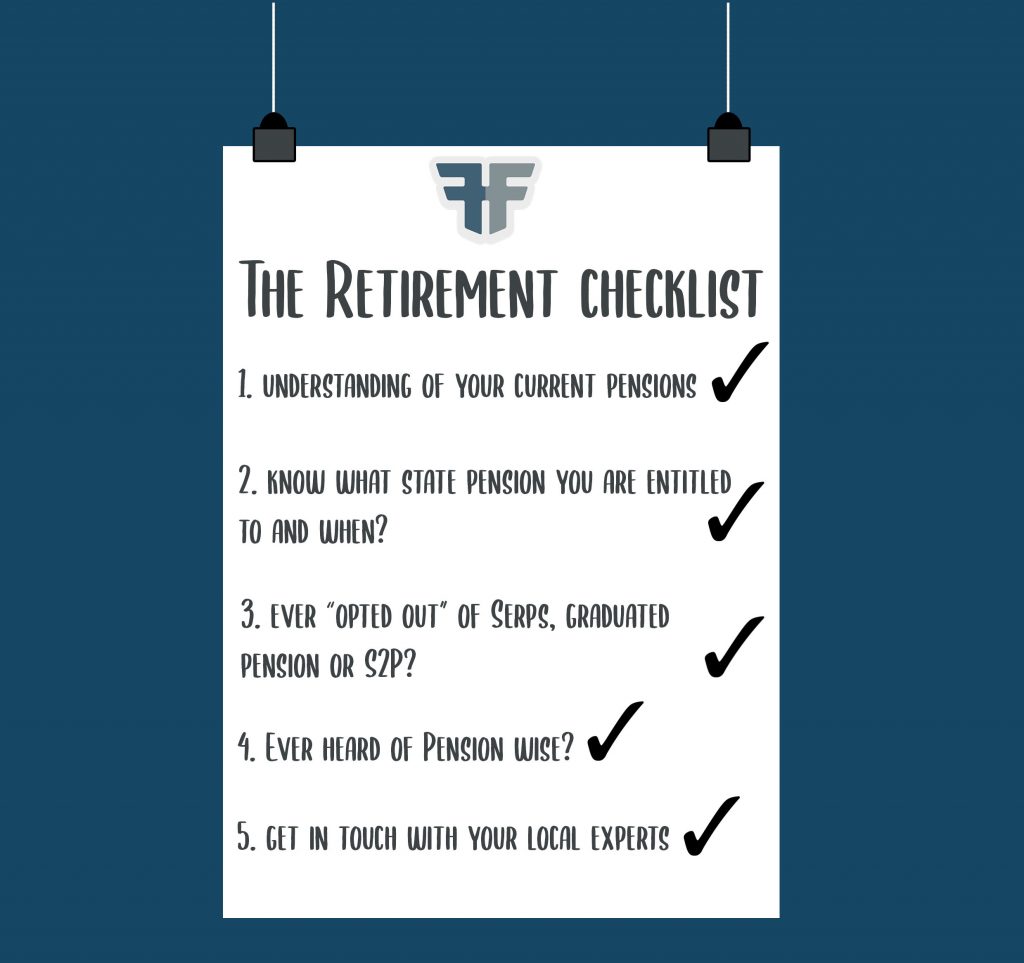

The Retirement checklist

Are you approaching retirement and want to get your finances in order? Here is the Financial Fortress guide to getting ready! Get an understanding of your current pensions. Do you know what they are worth? Whether you can draw lump sums or income? Do you even know where they are? Use our guide to tracing…

How Corona-virus has affected us so far!

In our blogs and articles were always banging on about the economy here or the economy there but we thought we would let everyone know about our business and how we have changed our practises to weather this storm! In fact, given the changes we have embraced it has arguably allowed us to thrive as…

Inflation – rock bottom (for now)

First things first, inflation is real even though we often over-look this! Remember how much a bag of crisps cost when you were a child? How much would a bag cost now? How many sweets were in a “10p mix up” whereas a 10p mix up probably doesn’t even exist anymore!! Inflation is the biggest…

Welcome to the team Bella !

We are delighted to announce the entrance to our team of Bella Scully as Marketing & Events Co-ordinator! Bella’s role is to further enhance our Marketing & Communications strategy, ensuring our existing and new clients remain of high priority whilst building their own Financial Fortress! Having worked over 6 years for an IT Services & Solutions company and over 20 years of experience being in the IT industry,…

BREAKING NEWS – Government announces they will raise the pension age!

In 2014, we were told this would happen – but the UK Government has now announced they will legislate to raise the age at which you can access your pension from 55 now to 57 in 2028. If you were born after 1971 you will be affected! So why are they doing it? Simply put…

Financial Fortress receives their first ever 4 star review

We are sad to reveal, we have received our first ever 4-star review! Read on to see what was said….. “Used Financial Fortress to review and sort out my pension pots which were several. The person that I dealt with was Wayne M. The service I received was fabulous! Would defiantly use them again and…

Attack of the pensions?

Now it doesn’t take a rocket scientist to realise that with the UK debt to GDP ratio surpassing 100%, the widely praised (so far) Chancellor of the Exchequer Mr Sunak now has a battle on his hands to reign in not only the spending but work out how this is to be repaid. In short,…

Financial Fortress welcome a new member to the team !

The countdown is over and whilst other companies seem to be shrinking, as usual Financial Fortress bucks the trend with no less than 2 new colleagues joining our ranks taking the team to 9 dedicated experts in all things financial! Emyr joins us from another team of advisers with huge pedigree reaching back to 1992…

Why have stocks rocketed?

According to Morgan Stanley, the stock market is “dislocated from reality” and looking at how far they have rebounded since the depths of Corona-virus this statement is not really surprising. The S&P (an American index) has rebounded more than 50% since the March lows and has actually now hit an all-time high today (18/08/2020)! The…

End of furlough but not the virus

The good news is, the world seems to be getting back to some normality on the employment front with business’s returning employees safely where they can. Even “higher risk” sections of the economy such as hospitality and catering are returning to normal and from an economic point of view – this can only be a good thing. …

Mortgage approvals at their lowest EVER level!

Bank of England data released today (20/08/2020) show that In May 2020, the number of mortgages being approved fell to their lowest ever recorded levels! The small print shows however that records only began in 1993 (which was also a time of great recession – remember the negative equity debacle?). This figure got better in June 2020 but were still nearly…

BREAKING NEWS (House prices and mortgage data)

The House of Commons today has published key economic indicators for the UK housing market and it makes for some interesting reading! Between April 2019 and April 2020 house prices (as measured by the UK House Price Index) increased by 2.6%. On a “seasonally adjusted basis” however, they have fallen by 0.9%. It also depends where you…

What are passive funds?

A “passive fund” can also be known as an “index tracker”, “index fund” or simply “tracker” and aims to replicate (or copy) a particular stock market index with the most common perhaps being the FTSE 100. As it doesn’t rely on fund managers or stock pickers, they tend to be an extremely cost-effective form of…

Another 5 star review for Financial Fortress !!!

Malcolm helped me secure a mortgage during a tricky time, after receiving two previous declines and in the middle of a pandemic!Malcolm provided honest and clear advice from the start. He ensured he only submitted my application to the most suitable lender by assessing my needs thoroughly and researching various lenders and products. He was…

LGBT Financial Planning Challenges

This Saturday sees Chester Pride coming to our living rooms for the first time with Chester Digital Pride. Its the carnival of colour and acceptance, but members of our LGBTQ+ community (and indeed opposite sex couples living together) face some very specific challenges to their finances which, given correct planning in advance can easily be…

Is it time to abolish the “triple lock”? – Beware if you receive a state pension!

If you have reached the grand old state retirement age (currently 67), the way your income escalates (or goes up for inflation) every year is currently guaranteed by something called the “triple-lock”. Basically, it means your state pension will be increased every year by the higher of 2.5%, price inflation or average wage increases. Now…

Inflation – a threat or an opportunity?

Now any regular reader will know that we always harp on about the threat of inflation being too high, indeed the Bank of England is legally charged with keeping this under control (2% is seen as satisfactory long term) but could inflation now come to the rescue of Governments and the population whose debts are…

Economic good news? Or bad news?

What a strange time we live in! Trying to navigate our clients investments through this turmoil is a nightmare given most of the data is only available “after the events” and depending on how you read it can indicate either good news or bad news! For example: Figures released last week show that the British…

Mortgages – very tough times for buyers!

Since the Corona-virus crisis, mortgage lenders have been withdrawing from various markets basically in complete fear! Why would you borrow someone money where their job may be at risk or at best only have 80% of their income? Low-points of the past 3 months include Nationwide pulling all tracker mortgages and no lender offering any mortgage with…

STOP PRESS – Chancellor gets rid of stamp duty for most transactions (but not if you live in Wales)!!

If your buying a property worth up to £500,000 until 31st March 2021 then the good news is, you don’t have to pay any stamp duty with immediate effect! This could save you up to £15,000 – Wow! However, if you live in Scotland or Wales, given stamp duty is a “devolved matter”, you will still have to…

Can history tell us anything about markets?

One of the most important sayings we have is “past performance is no guarantee of future returns” but can turning to history ever help spot long term trends? Particularly as we are in the middle of a technical depression that has not been seen in modern times? There are very few parallels to this “Corona-crisis” but you…

HMRC – How ruthlessly will they claw back “corona-aid”?

So what do I mean about “Corona-aid”. The facts are the last 3 months have been extremely expensive times for the tax-man and a combination of people not paying tax (think VAT holidays, 80% wages and corporation tax delays) plus huge payments out of furlough wages and guaranteed support to companies and the self-employed, this…

Another 5 star review for Financial Fortress !

What a brilliant group of professional people! My particular interest was getting my Pension sorted out, which has been accomplished perfectly. Thank you Wayne, Ian, Kieran and everyone else I met, at your Office.I am grateful for your help, and amazed at the speed and effectiveness of your work! Flying in from Canada to take…

Millions of pensioners relying on just £7,000 per year!

Recent statistics from the Pensions Policy Institute (PPI) and sponsored by Age UK show that the poorest pensioners are relying on the state pension for over three quarters (78%) of their income. Where other state benefits such as housing benefit or pension credit are included, this figure rises to a whopping 86% of income being…

If you have a pension, you are a potential scam victim!

I know we constantly bang on about it but – pension scammers are scum bags that pillage the life savings of innocent hard-working people on a daily basis but…it seems the tide may be turning! Since the summer of 2018, the Government has been running campaigns (including TV adverts) warning people not to “let a…

Millions of pensioners relying on just £7,000 per year!

Statistics from the Pensions Policy Institute (PPI) and sponsored by Age UK show that the poorest pensioners are relying on the state pension for over three quarters (78%) of their income. Where other state benefits such as housing benefit or pension credit are included, this figure rises to a whopping 86% of income being provided…

Is now a good time to buy a house?

The British and their castles… I mean err houses! We have definitely seen an uptick lately in the number of enquiries for people to raise mortgages. I would even go further and say probably 75% of enquiries are from first time buyers which, from a housing market point of view is a very good sign!…

Shares to buy?

During this crazy and unexpected time, there are some investments that continue to provide good returns and we get asked all the time, what should we buy? We often talk about “defensive stocks” making up the bedrock of any portfolio. Defensive stocks are said to have “elastic demand” and what this means is no matter…

What are “futures” and what do they have to do with our supply chain?

At the beginning of the Corona-virus crisis, when every one was panic-buying their toilet rolls and hand sanitizer I was explaining to the team how complex and lengthy our supply chains really are. Take apples for example, it takes around 10 years for an apple tree to produce enough fruit to make planting one worthwhile…

Have we avoided a depression?

Firstly, anyone reading this will be far too young to have experienced first hand a real “depression” but during a recent chat with a senior Director or a UK Bank (which shall remain nameless), they suggested to me that the Board was seriously planning for such an eventuality. A depression is a sustained and long-term…

Will taxes rise?

When all this Corona-virus first kicked off, we were very relaxed about it and thought that the indestructability of advanced and ultra-modern medicine would soon see the virus off and the first time we seriously realised that something was seriously amuck was when UK Government borrowings went into overdrive! Since then, we estimate the Government…

End of the tax year = STRESS!

Why is it once again, we find ourselves inundated with clients trying to “beat the tax-man” and use their tax allowances before the end of the tax-year when they have had all year to plan? Oh well, just a good job we are fully staffed (albeit working from home) and willing to help then, but…

Pension scams (and the Corona-virus)

According to the “Financial adviser” (an industry news-paper) there has already been £970,000 lost in Corona-virus linked pension scams since the start of February! Demonstrating further that even in these confusing times you can never be too careful with your savings and whilst the country is generally pulling together and achieving amazing things, there are…

Nationwide pulls all tracker mortgages!

Nationwide Building Society, the UK’s second largest mortgage lender, has pulled all its tracker mortgages from the market following the Bank of England’s decision to reduce interest rates to an ALL TIME RECORD LOW of 0.1%! There are however many other lenders still in the market and being independent we have access to most and…

Coronavirus – an update (sources of much needed assistance if needed)

Holy shmoly! (that is a technical financial adviser term by the way so sorry for the jargon) but what a time we are in! Any way in this-fast moving environment we thought we would update you with some more sources of assistance in this chaotic time. We continue to manage our client’s wealth to…

Don’t panic!

Another very tough day in the markets after Friday’s brief lull (which we now know was a “Dead cat bounce”). So, what is going on? The answer is actually quite simple – no-one knows – which is why we are now firmly in the eye of one of the most chaotic investment storms we have…

Interest rates slashed!

If you are the proud owner of a property, chances are you will probably have a mortgage meaning the recent reduction in the “Bank of England Base Rate” has meant you now have opportunity to pay the least amount of interest ever! The lenders amongst us (Banks, Building Societies etc) were already tripping over themselves…

Emergency base rate change – what does it mean?

“Money makes the world go round” or so goes the saying and one of the most important “tools” that those responsible for governing the economy has, is the decision to raise or lower interest rates. A very cumbersome tool as it is difficult to be used in a targeted way and is set by The…

Increasing financial in-security?

1 in 6 UK adults in their early 30’s are postponing either buying a home or having a family due to fears about the financial impact on their lives!! According to a recent YouGov survey. Nearly one-quarter (24%) of 30-35 year olds said they were concerned about the financial impact of major changes in their…

Average ADVISED client better off by £47,000!

Client’s receiving professional & ongoing financial advice between 2001 and 2006 were on average £47,706 better off by 2014-16! Wow what a stat and really shows the potential power of using a great financial adviser (like us)!! Research by Royal London and the International Longevity Centre (ILC) released recently went on to say that “people…

The Financial Fortress guide to The Coronavirus and your investments…

Whilst the virus has been in the news since last year, as the coronavirus was generally contained to China, markets had largely ignored it until this week when news emerged that it was spreading more quickly to the “developed world”. This has then fed through to markets this week resulting in a sell off in…

Financial Fortress welcome a new member to the team !

Leading local financial advice firm, Financial Fortress Ltd continues to invest in new talent with their latest apprentice, Ryan Hardwick joining their friendly team in Chester. Ryan joins Financial Fortress as Apprentice Marketeer having previously worked for a Supermarket. He has already been enrolled on the Government recognised Level 3 Digital Marketing course and is…

Our new branding

Our eagle-eyed readers may have noticed our new branding which we have been developing over the last few months! Apparently, it is more in tune with our “friendly”, “local” and “jargon free” attitude to providing the best standards of financial planning. We hope you like it, get in touch and let us know! Our new…

Financial Fortress opens Wrexham office!

Based in Wrexham and want to contact your local experts? You can now call 01978 788559 or pop and see us in our new offices on Chester Street, in Wrexham’s town centre! Our clients know we love to help them and we continually strive to make visiting us as hassle free as possible. Give us…

Team photo

We had a photographer visit our offices yesterday and we are really pleased with the results! What is it about photos though that makes us all feel uncomfortable? It’s only a camera! Anyway, here is a great team shot of us all looking slightly uncomfortable… as always get in touch with your dedicated expert to…