What is Life Insurance Cover?

Life Insurance is policy that pays out a one off, lump sum to a named beneficiary or family member should you die or have a terminal illness within the policy term.

The policy will end after the lump sum has been paid or the term of the policy expires.

Knowing you have life insurance in place can financially benefit those you leave behind and provide the financial protection needed, ensuring your peace of mind whatever may happen!

Benefits of Life Insurance

The cash lump sum can be used to:

How can we help?

Our advisers will:

When Looking For Life Insurance

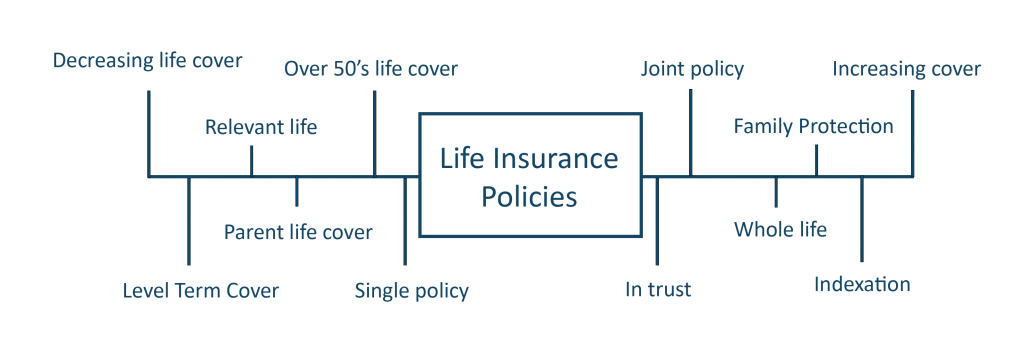

There are many things to consider when taking out life insurance policy. For instance, types of cover that are available, how long you need it for, who the policy is for to how big you want any payment to be. Whether it’s single or joint cover, an over 50’s policy or even family protection, our INDEPENDENT & JARGON FREE experts are here to help!

Example 1, with a mortgage:

A policy that decreases in value (in line with your mortgage) as you make repayments during the term. Thereby paying out a sum equal to your mortgage!

Example 2, with family protection:

Child aged 3 and you feel they will remain financially dependent until age 21 and the income required is £10,000 per year. The simple maths is 21-3 = 18-year term. £10,000 x 18 years = £180,000 policy needed

Then comes the job of comparing all the life insurance quotes from different providers and making sure your policy is right for you.

Our experts can make the process much easier for you. We will get to know you, your family and situation free of charge before researching the most suitable policy for your needs. your dedicated expert will answer any questions or concerns you have and take away the stress of finding the right plan.

At Financial Fortress, we don’t just guess your needs. We have years of experience using tried and tested formulae to help provide necessary information.

Although life insurance is an investment you are making, take comfort knowing your loved ones will be secure. There are plans that can be obtained from as little as £1.00 per week and you also have an option to add Critical Illness Cover to your plan at an extra cost if you wish.

The complexity of Life Insurance Policies

What you get with Financial Fortress

Professional and qualified advisers

No cost or obligation initial review meeting.

A personal named and dedicated expert dedicated to you!

No cost or obligation meeting for everyone! We will offer personalised advice via your own named and dedicated adviser, either in person, over the phone or using modern video-conferencing!