Looking for pension & Retirement advice? We offer all clients a no-cost and no obligation review at our office, your home or using video conferencing technology!

At Financial Fortress, we maintain the highest levels of service and guarantee no jargon! No long wait times on the phone and easy to reach named & dedicated advisers!

With over a combined total of 100 5-star reviews, Financial Fortress is one of the most recommended independent financial advisers in the north west.

What is the State Pension?

The state pension is a regular payment (usually weekly) that you can claim from the Government when you reach your “state pension age”. What you will receive depends on your national insurance (NI) contribution record during your working life. Did you know, you can get a free forecast? Read on!

Our easy step guide!

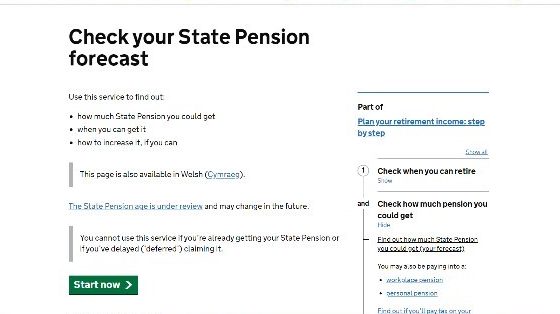

STEP 1

Go to the GOV.UK check pension forecast page – https://www.gov.uk/check-state-pension

STEP 2

Scroll down and click on the green ‘start now’ button.

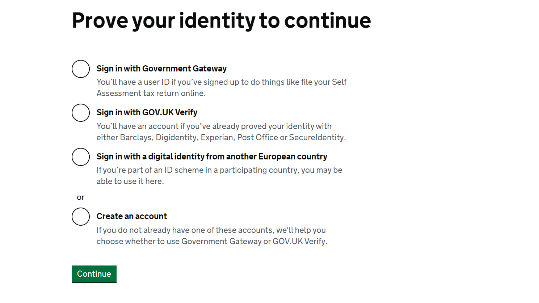

STEP 3

Next take the appropriate steps to log in or if you do not have an account please create one.

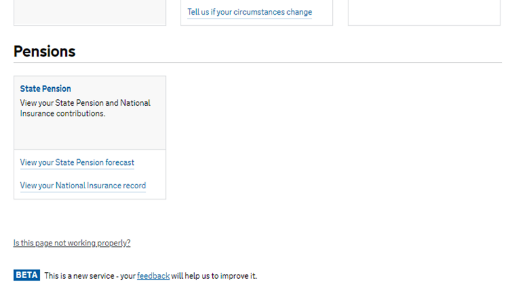

STEP 4

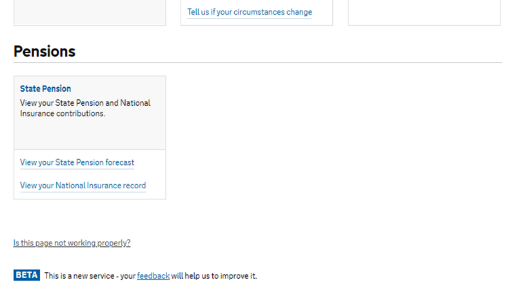

You should now be on a page that looks like this. Now you need to scroll down to the pensions section at the bottom and select ‘View your state pension forecast’

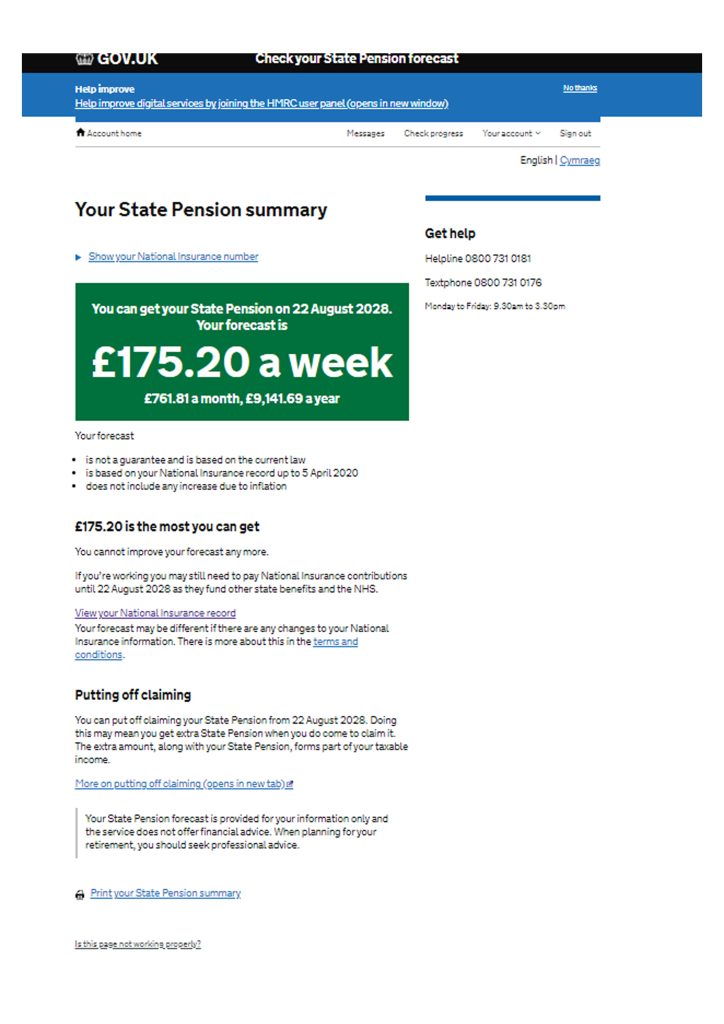

STEP 5

Once you have landed on your state pension summary page you need to scroll to the bottom and click on ‘print your state pension summary’

A pdf version of your State pension summary will then pop up. You need to save this document as you will need it later on.

STEP 6

Now return to the previous page and scroll down to the pensions section again. This time you will need to click on ‘view your national insurance record’

STEP 7

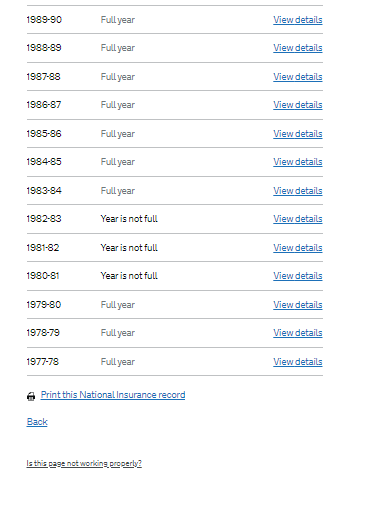

Once you have landed on your state pension summary page you need to scroll to the bottom and click on ‘view your national insurance record’ repeat the same process as earlier and save the pdf to your files.

STEP 8

You should now have saved both your state pension summary and your national insurance record as a pdf in your files. Your last step now is to email these files to your adviser.

To Print This Guide Please Click Here!

For a GOV.UK Verify account, which should take around 15 minutes to set up, you will need:

– A UK address.

– A valid UK passport or photo card driving license.

To create a Government Gateway account:

State Pension FAQ’s

How do I check my state pension forecast?

You can complete something called a “BR19” which is a state pension forecast. This is completed via the “Government Gateway” and a full guide with clear instructions is above. You need to create an account and have some ID with you, if you are struggling with the on-line version, there is also a form that you can full in and send to the DWP (Department for Work and Pensions) instead https://www.gov.uk/government/publications/application-for-a-state-pension-statement. You will then be given a clear forecast of what your entitlement will be, whether you have any gaps in your national insurance record and what you can do about it. If you need help, don’t hesitate to get in touch with an expert at Financial Fortress!

When will I get my state pension?

State pension age is subject to change, for example women used to be able to claim it from age 60 and Men 65. State pension age is currently 67 for both Men and Women however this is going to rise further to 68 by 2046. If life expectancy continue to rise in the future, Uk legislation allows future Governments to raise it even further. A great financial adviser will assist you in understanding the state pension, explain options for topping it up and what it means to your retirement.

Does it increase every year?

Currently the state pension is increased every year and subject to something called the “triple lock”. Inflation erodes the value of your income, meaning if your state pension didn’t increase, it would actually lose its real value from year to year. State pension is increased by either 1. Average earnings, 2. CPI (Consumer Price Index) or 3. 2.5% whichever is higher. However, any Government could alter, change or suspend this at any time as seen in 2022. The inflation rate is measured every September with the necessary increase being applied from the following April.

How many years NI do I need for a full state pension?

Health warning, as always anything can be changed by any Government at any time, however currently state pension entitlement is accrued by paying sufficient National Insurance contributions. You pay national insurance either while working and paying national insurance or whilst claiming certain benefits such as unemployment or child benefit for example. You will need 30 qualifying years to get full state pension and you will need atleast 10 years to receive any state pension. Where you have more than 10 years but less than 30 years national insurance contributions, you will receive a pro-rata amount. For example if you have 20 qualifying years, you will get 20/30ths of a full state pension. Your financial adviser will help you get your forecast, help you understand it and how this fits in with your retirement.

Can I top up my state pension?

Yes you can but you need to make sure it is worth it! It is very complicated and depends on your date of birth to see which “system” you fall into however, for the new system you can pay Class 3 voluntary national insurance contributions and can usually only fill missing years from the last 6 years. As stated there are exceptions but if you have a shortfall it usually costs around £800 per missed year and roughly takes around 3 ½ years to get your money back. Don’t top up too soon however as if you die before reaching state pension age then it could be a complete waste of money! Your adviser will explain all this and advise whether in your personal circumstances it is worth it. Pension provider Royal London has an excellent guide here: https://www.royallondon.com/siteassets/site-docs/media-centre/good-with-your-money-guides/topping-up-your-state-pension-guide.pdf

Ready to build your Financial Fortress?

Professional and qualified advisers

No cost or obligation initial review meeting.

A personal named and dedicated expert dedicated to you!