What is the Money Purchase Annual Allowance (MPAA)?

Figures correct as at 2025/26 tax year!

On 06th April 2015 the UK Government introduced the Money Purchase Annual Allowance (MPAA) to essentially discourage people from abusing the generous tax and national insurance regime that can be obtained by using pensions. It is designed so that if you draw pension benefits flexibly (make taxable withdrawals over certain limits) you will forever be restricted in how much tax-relief you can subsequently claim on pension contributions.

Normally, a relevant UK individual can receive tax relief (and possibly National Insurance relief) on contributions to a pension up to £60,000 per year or 100% of your taxable income if lower. Furthermore, employers can also contribute in excess of your salary up to your £60,000 per year limit. This is known as the “Annual Allowance”.

Under certain circumstances, you will permanently lose this £60k annual allowance by triggering the “Money Purchase Annual Allowance”. Once triggered, it is irrevocable and permanently reduces the future tax relief you (or your pension provider) can claim to total contributions of just £10,000 per tax year. A £50,000 reduction!

You will normally trigger the reduced MPAA when:

- You take an entire pension pot as a lump sum

- Start taking ad-hoc taxable lump sums from your pension

- If you designate a pension to flexi access drawdown and draw even 1p of income.

- If you buy a flexible or investment linked annuity (where your money can go up and down) and receive an income payment

- If you have an old fashioned “capped drawdown plan” (pre-April 2015) and convert it to flexi-access drawdown.

You normally will not trigger the MPAA where:

- You do not make any withdrawals from your pension

- You take just the Pension Commencement Lump Sum (PCLS) – otherwise known as “Tax-free cash lump sum” and don’t draw any taxable income or designate the remaining funds into drawdown.

- You purchase an annuity (a guaranteed income for life) that either stays level or increases regularly

- Take scheme benefits from a Defined Benefit (AKA final salary) arrangement

- You cash in a maximum of 3 small pension pots valued at less than £10,000.

Having triggered the MPAA

You trigger the MPAA (and are then due to pay further tax) if you pay over £10,000 (or accrue more than £10k in benefits) in pensions having triggered the MPAA from either the:

- day after you first flexibly accessed your pension to the end of the tax year

- whole of the tax year if you flexibly accessed in a previous tax year

You cannot use unused allowances from previous tax years to reduce the amount you’ve gone above the money purchase annual allowance by (ie: Carry-back is no longer available). If you (or your employer) contribute into a pension above the MPAA, you are required to pay tax on all pension savings that go above the £10,000 gross limit..

Notification rules

Where a member triggers the MPAA, they then also have a responsibility to notify all and any remaining pension schemes with the fact the MPAA has been triggered. The scheme that they triggered the MPAA with will write to them stating when the triggering payment was made within 31 days of the flexible access having occurred. The affected member will then have 91 further days to advise all remaining schemes to which they are members of (or become members of in the future) that they have triggered the MPAA. Failure to advise all schemes within the prescribed limits can incur a £300 fine and daily penalties of up to £60 per day!

Payment of the tax charge

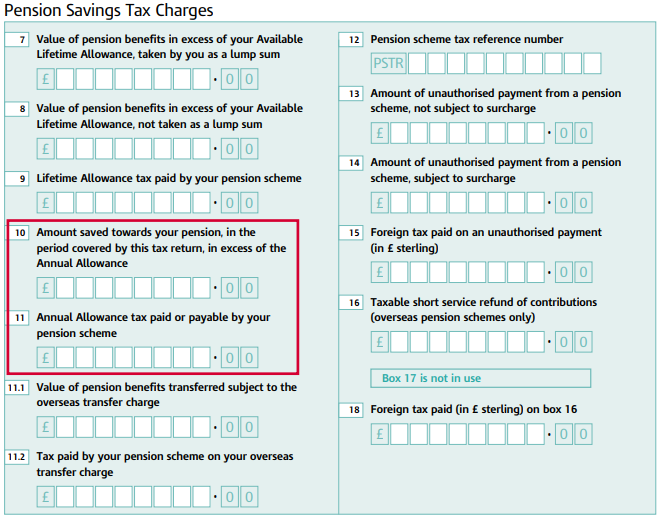

If you trigger the MPAA and continued to accrue pension benefits (or contribute) – (even via employer contributions), you are now required to pay a tax charge. This should be paid either via “voluntary scheme pays” or via self-assessment even if you have not been required to complete one in the past.

We are unable to assist with this any further and recommend you instruct an accountant to assist further. If you do not have one, we can recommend one locally to Chester whom’ may be able to assist on the phone/via email etc.

You will need to complete the “additional information pages” of your tax return and specifically the “Pension Savings Tax Charges” section here:

Ready to build your Financial Fortress?

Professional and qualified advisers

No cost or obligation initial review meeting.

A personal named and dedicated expert dedicated to you!